CRUZ BAY— Members of the 33rd Legislature have begun the process of revamping local insurance regulations in order “to better protect Virgin Islands property owners.”

After hearing testimony from insurance companies and Virgin Islands officials on Wednesday, Senators were largely in support of Bills No. 33-0015 and No. 33-0016.

The legislation, proposed by Governor Albert Bryan Jr. on behalf of the Administration, will amend local laws to satisfy standards established by the National Association of Insurance Commissioners (NAIC).

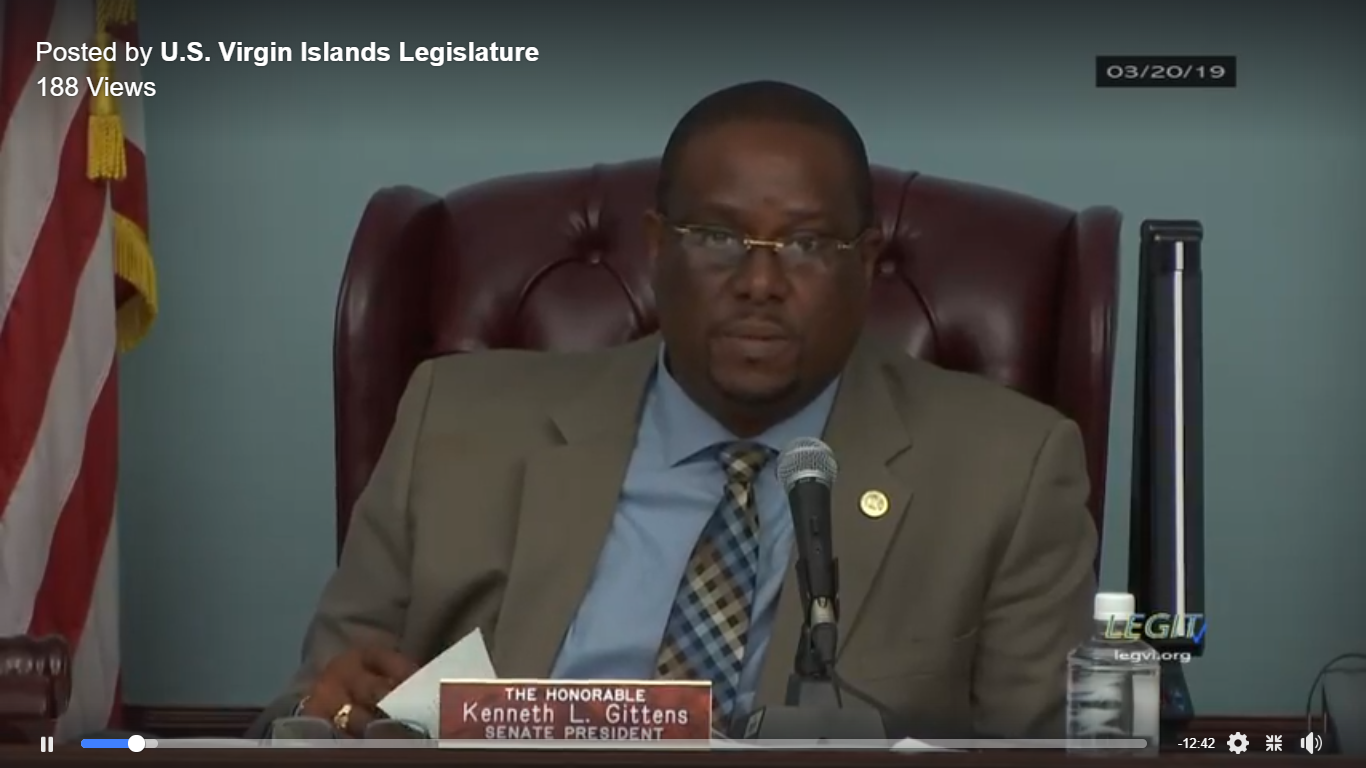

During the Committee of the Whole meeting on St. John chaired by Senate President Kenneth Gittens, Senators learned more about the importance of bringing the territory’s decades-old insurance laws into compliance with national regulations. Bill No. 33-0015 will update the territory’s insurance laws to put them on par with other United States jurisdictions and help satisfy the accreditation standards established by NAIC.

Senator Gittens had questions about the benefits of NAIC accreditation, particularly for Virgin Islands consumers.

“We need to ensure our laws maximize protection for Virgin Islands property owners,” he said.

The Director of the Division of Banking, Insurance and Financial Regulation, Gwendolyn Hall Brady, said accreditation places the Virgin Islands in an overall better light, while assuring uniformity in the territory’s insurance laws so that companies doing business across state lines will not have to satisfy different requirements.

Director Brady also testified that NAIC membership brings additional benefits, to include staff training and access to information databases to prevent fraud and protect consumers.

Senator Marvin Blyden expressed his support for the measure, highlighting the fact that all 50 states and Puerto Rico are already NAIC accredited. The Majority Leader indicated that the 33rdLegislature was ready to act and urged the Division to propose other updates to the territory’s insurance laws.

“Can you try and get all these needed amendments together, please,” Senator Blyden said.

Director Brady testified that she and Lt. Governor Tregenza Roach, who is the territory’s insurance commissioner, will meet with NAIC on April 5 in Orlando, Florida to determine what other legislation may be required.

Senator Novelle Francis, Jr. highlighted the need to continually assure the solvency of the Insurance Guarantee Fund and thanked the Division of Banking, Insurance and Financial Regulation for its efforts.

“People don’t understand the important work you do until they need you,” Senator Francis said.

While Bill No. 33-0015 amends section 105(f) of Title 22, V.I.C. to meet NAIC accreditation standards, Bill No. 33-0016 adds a new chapter in this regard to Title 22 entitled, “The Risk Management and Own Risk and Solvency Assessment Act.”

This legislation further protects local policy holders by implementing financial safeguards to assure the ability of insurers to pay out for claims.

Senator Gittens said the legislation required some minor amendments before being voted on by the full body and that both bills would be promptly assigned to the appropriate committee for further action.

“The eventual approval of these measures will move us closer to the accreditation we need and I thank the testifiers for their participation and my colleagues for their thoughtful questions,” Senator Gittens said.

Senators also considered a request to rezone a residential property on St. John for commercial use. The approval of ZAJ-19-1 will change the zoning of Parcel No. 285 Estate Contant & Enighed from R-4 (Residential-Medium Density) to B-1 (Business-Central Business District). Applicants Frank A. Powell Jr. and Nancy Powell-Callwood, plan to open a salon and beauty supply shop on the site. Diva’s Beauty Supply was previously located in a building destroyed by Hurricane Irma.

In an emotional presentation before the 33rd Legislature, Powell-Callwood explained the many challenges she faced following the destruction of her shop. Once she identified suitable family property, she traveled to Puerto Rico to purchase a modular building to house her business.

“I have tried to do everything right,” Powell-Callwood said.

The Department of Planning & Natural Resources, represented by Assistant Commissioner Keith Richards, had no objections to the rezoning change.

They further reported no community opposition to the rezoning. Members present at Wednesday’s hearing in addition to Senators Gittens, Blyden and Francis, included Senators Stephen Payne, Stedmann Hodge Jr., Kurt Vialet, Javan James Sr., Athneil “Bobby” Thomas, Myron Jackson, Oakland Benta, Allison DaGazon and Janelle Sarauw. Senators Alicia Barnes and Dwayne DeGraff were excused from St. John’s Committee of the Whole proceedings. Senator Donna Frett-Gregory was absent.