]CHARLOTTE AMALIE – The United States Department of Treasury announced Wednesday that it has approved Governor Kenneth Mapp’s nomination of 14 neighborhoods on St. Thomas and St. Croix as Qualified Opportunity Zones eligible for U.S. tax breaks under the massive tax bill passed by Congress last December.

Governor Mapp has said the new federal tax incentives will strengthen and complement the benefits already available to companies and individuals under the Virgin Islands Economic Development Commission program.

“These new incentives can help us attract new investments in hotel development, retail businesses and industry in our most underserved communities and can also help those looking to rebuild after the hurricanes,” the governor said. “I would like to thank the U.S. Department of Treasury Secretary Steven Mnuchin and his team for implementing this important program.”

Governor Mapp once again commended Senator Tim Scott (R-SC) for his leadership in developing the Opportunity Zone legislation and spearheading it through the Congressional process. The original proposal did not include the Virgin Islands or other U.S. territories. After meeting with Governor Mapp last summer, Senator Scott agreed to expand the scope of eligible zones to include low-income communities in the territories.

As part of the Tax Cuts and Jobs Act of 2017, Congress created the Qualified Opportunity Zone incentive to encourage investment in communities designated as economically distressed by allowing investors who reinvest the proceeds of capital gains in qualifying properties or businesses located in designated Opportunity Zones to defer and reduce their capital gains taxes.

Under the new tax law, U.S. investors who invest in qualified property in an Opportunity Zone may defer U.S. capital gains tax on the new investment for up to seven years; reduce the amount of those capital gains by as much as 15 percent; and pay zero federal capital gains tax on any appreciation in value of that new investment.

The Treasury Department approved Opportunity Zones for: American Samoa, Arizona, California, Colorado, Georgia, Idaho, Kentucky, Michigan, Mississippi, Nebraska, New Jersey, Oklahoma, Puerto Rico, South Carolina, South Dakota, the U.S. Virgin Islands, Vermont and Wisconsin.

The areas nominated by Governor Mapp include Christiansted and all of the western end of St. Croix, as well as most of the southern half of St. Thomas. Qualified Opportunity Zones retain this designation for 10 years.

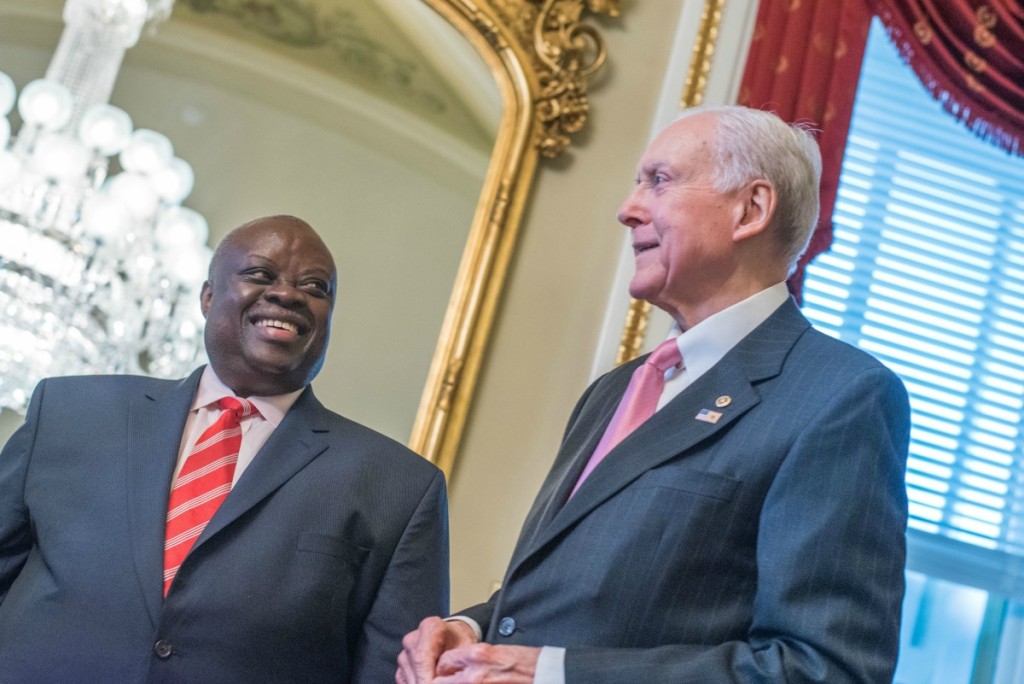

Gov. Kenneth Mapp and U.S. Treasury Secretary Steven Mnuchin