CHRISTIANTED — The U.S. Virgin Islands has called off efforts to sell its rum-tax collections to bondholders, extending the territory’s decades-long banishment from credit markets.

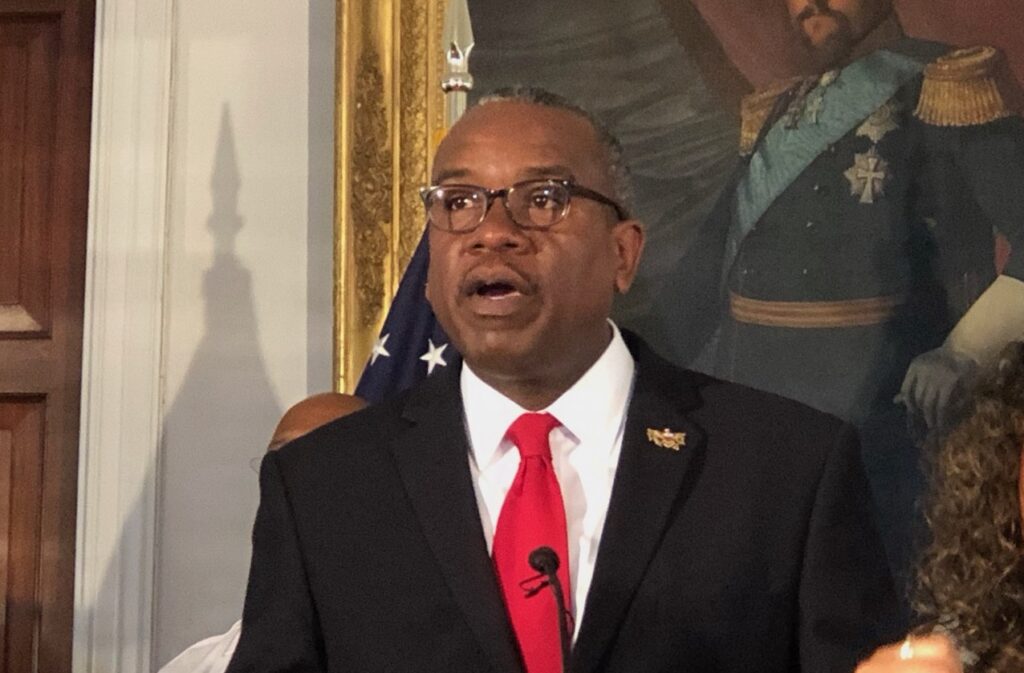

Governor Albert Bryan, Jr. said the territory had suspended a proposal to sell nearly $1 billion in securitization bonds, dashing for now his ambitions to generate some short-term fiscal relief for the cash-strapped government.

Government House in St. Croix released the following statement from Bryan today:

“As Governor of the U.S. Virgin Islands, I want to advise our citizens and our investors that the anticipated transaction set forth in Act No. 8329 and Act No. 8330 related to the Matching Fund Securitization Corporation (Special Purpose Vehicle) in which we sought to refinance and significantly reduce the territory’s debt for interest costs savings has been suspended.”

“Despite the great interest initially demonstrated by potential bondholders, this decision became necessary given the negative impact of ill-intentioned litigation deliberately filed in the Superior Court of the Virgin Islands on the eve of bond pricing and closing.”

“Additionally, changes on September 18th to the ratifying legislation created uncertainties and deprived us of the opportunity to successfully re-enter the market and close before the authorization’s sunset date on September 29th as required by law.”

“The transaction was intended to improve cash flow, in part, from reducing the debt service payment of $85 million on USVI bonds due October 1st. This was always the critical event that dictated the transactions timeline. That debt service payment is still due on October 1st and will be paid on schedule.”

“However, the intended savings and future savings would have funded various projects in the Virgin Islands, and most specifically, provided a down payment on helping reduce a portion of the deficit of the Government Employees’ Retirement System. There is a looming 40 percent cut in benefits for almost 8,700 retirees, some of the most vulnerable amongst us, forecasted to take effect in January 2021.”

“Simply put, we will continue to pay out millions of dollars towards the Government’s debt at full rate instead of taking in millions of dollars at reduced interest rates to accomplish what would have been a fresh start for our economy. However, I will work with our financial and legal advisory teams and the Legislature with increased vigor to develop alternative options to try to gain an equivalent amount of savings that can be applied to the same projects within a short time frame.”

“As a cautionary note, the results may be on different terms and not as lucrative to our financial recovery. This administration will continue to update the public on what alternatives are found that can be implemented to provide resources for funding our critical needs. We will do our best. We pray that the market conditions remain favorable to this renewed effort.”

“Thank you once again to the majority of the members of the Virgin Islands Legislature, who saw the need to take decisive action in support of this initiative and afforded us the opportunity to pursue these potential savings. I ask for their continued support in these efforts. We are open to recommendations from all senators on how to relieve our long-standing financial burdens, especially to the GERS pension system.”

“We thank the legal, banking and financial professionals, the Federal Government, and the Delegate to Congress for working with us in our effort to make the transaction successful.”