CHARLOTTE AMALIE — The U.S. Virgin Islands’ lost excise tax revenue grew to at least $74 million last month.

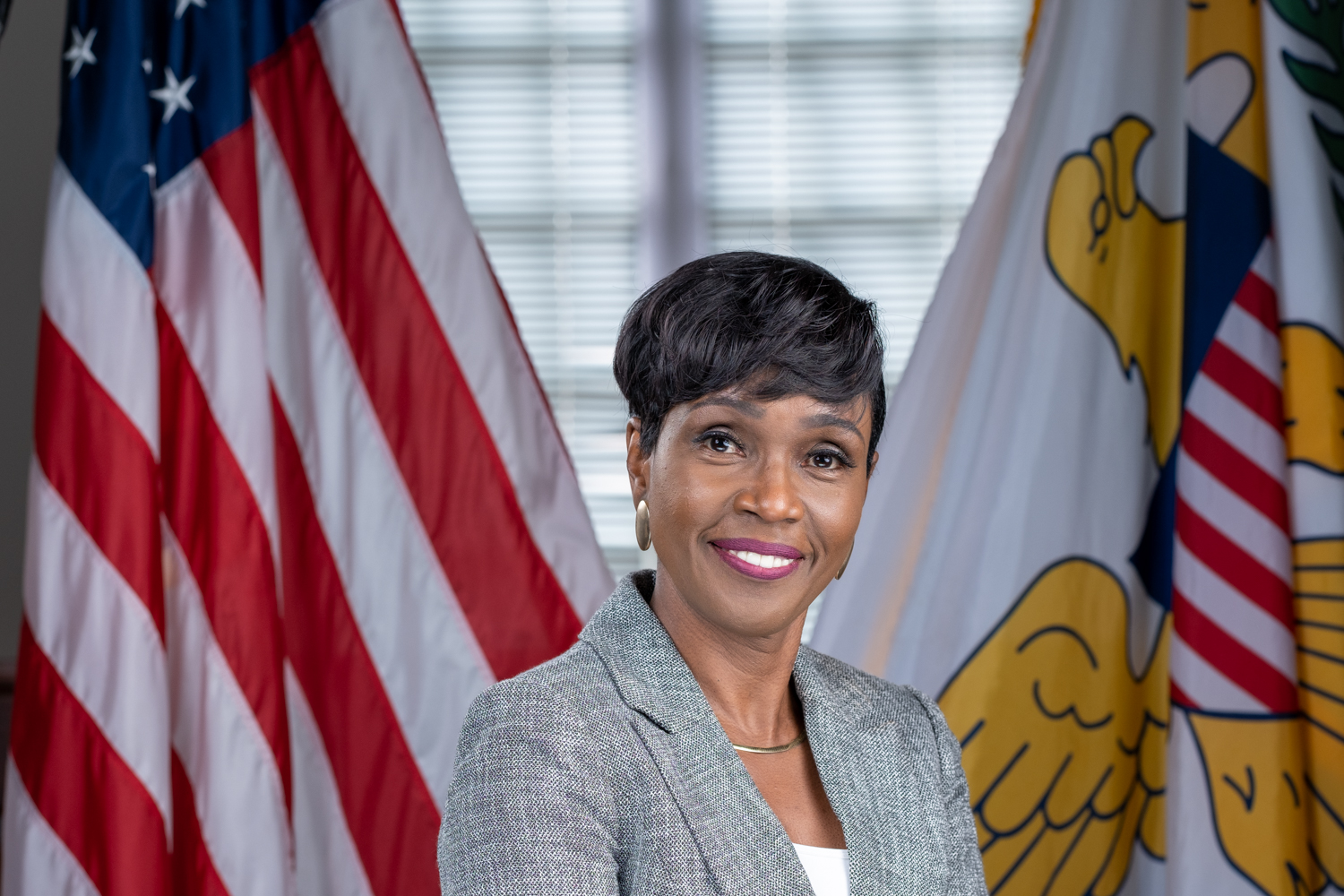

And Virgin Islands Attorney General Denise George thinks a Third Circuit Court of Appeals ruling made yesterday paves the way for the territory to resume collecting excise taxes.

U.S. District Court Judge Curtis Gomez stopped the local government from collecting excise tax in November 2018. Gomez said that that his temporary injunction stay in effect until USVI officials could prove they were applying the tax equitably in accordance with the provisions of the Commerce Clause of the United States Constitution.

AG George appealed that decision to the Third U.S. Circuit Court of Appeals in Philadelphia.

The decision refers to the case of Reefco Services, Inc. versus Virgin Islands Bureau of Internal Revenue, in which the territorial government appealed the federal court decision that kept BIR from collecting excise taxes, “thereby costing the GVI millions of dollars in revenues,” George said.

In the Third Circuit Court opinion issued Wednesday, the court upheld the District Court’s decision that forbade the BIR from collecting excise taxes because it was “unconstitutionally assessed against importers, but not local manufacturers,” the AG said.

But the Appeals Court threw out the District Court’s order not allowing the excise tax to be charged on importers, with the proviso that the government would no also charge the tax on manufacturers.

“We, therefore, affirm the District Court’s declaratory and monetary relief ordered in its September 28th Judgment and Opinion,” the Appeals Court ruled. “We also affirm the District Court’s November 26th Memorandum Opinion in part, as to its enjoining of the GVI from continuing to collect excise taxes from importers, but not local manufacturers.”

“We vacate the District Court’s November 26th Order in so far as it requires court approval of promulgated rules and regulations by the GVI and remand for further proceedings as to whether the excise tax has been assessed against local manufacturers. Upon obtaining proof that the GVI is assessing the excise tax on local manufacturers, we direct the District Court to lift the injunction.”

George said she was pleased with the court’s ruling.

“This can work out quite well for the GVI in that it paves a way forward

for us to start collecting excise taxes, hopefully in the near future It is important to note that Reefco has 14 days to petition for a rehearing,” she said. “If no further action is filed in the Third Circuit, the decision becomes final in 30 days upon the Court’s issuance of a mandate.”