CHARLOTTE AMALIE — President Joe Biden signed the new $1.9 trillion rescue package last week, providing for payments to qualifying individuals of up to $1,400, with payments to a qualifying family of four of $5,600. It is known as the American Rescue Plan.

People who make $75,000 or less a year are eligible for the full $1,400 payment. Couples earning $150,000 or less will receive a $2,800 check.

Those with children will receive $1,400 for each dependent child.

It is estimated that 85 percent of Americans will be eligible for the payments.

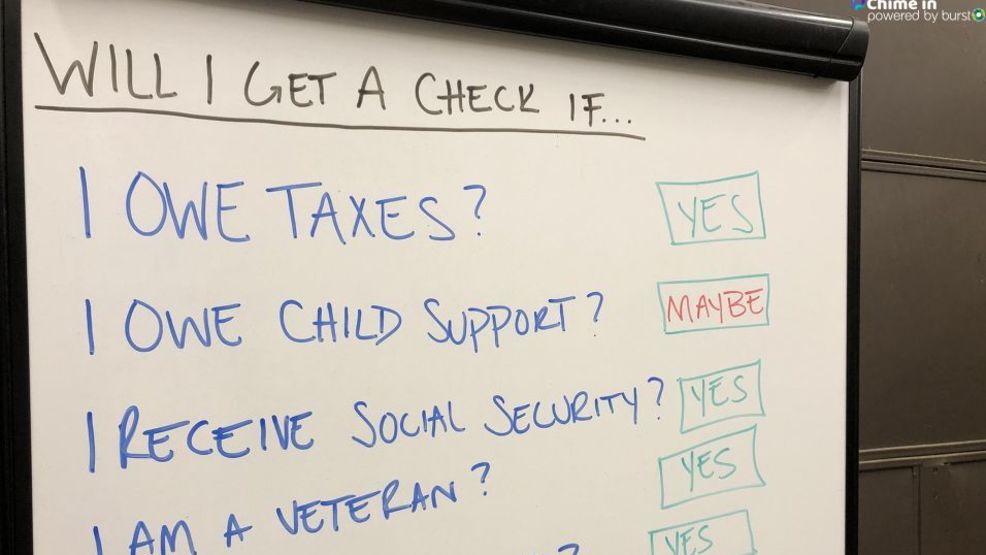

But what if you owe money? Can the government take it from your stimulus check? What about private debt collectors?

Several Virgin Islands Free Press readers texted us the question — and it is a top search question online as funds begin to roll out. The V.I. Free Press went to the experts to find out.

THE QUESTION

Can creditors garnish your $1,400 stimulus check?

THE ANSWER

The funds can’t be garnished to pay government debts like back taxes and child support, however, private debt collectors can garnish for debts such as private student loans, credit card debt, and medical debt.

WHAT WE KNOW

If you owe money and are expecting to receive a stimulus payment, a debt collector could garnish it. Because the American Rescue Plan was passed through a process known as budget reconciliation — not like a typical bill, stimulus payments are vulnerable to debt collectors, Fortune Magazine reports. In other words, your money can be garnished if you owe any private debt to collectors.

Last spring’s $1,200 stimulus checks weren’t shielded from private garnishment or child support, as well, according to Yahoo! News. The more recent $600 payments were protected.

The American Bankers Association wrote a letter to congressional leaders last week asking lawmakers to close the loophole, Fortune first reported.

“It is simple to code the payments as exempt, and we believe it is imperative that Congress ensure that these next stimulus payments are treated as ‘benefits’ subject to the federal exemption from garnishment,” the letter reads, in part. “Otherwise, the families that most need this money—those struggling with debt and whose entire bank accounts may be frozen by garnishment orders—will not be able to access their funds.”

In addition, the V.I. Freep Financial Analyst explained there’s something that people who didn’t get their first or second stimulus check up front and qualify to receive it as a recovery rebate credit on their 2020 tax return should know. He said they won’t be protected from the money being garnished and offset for unpaid taxes and debts owed to federal and territorial agencies.