CHARLOTTE AMALIE — Favorable revenue forecasts might not be enough to offset the territory’s mounting expenses, government financial leaders said during a 2024 Spring Revenue Estimating Conference at Yacht Haven Grande iin St. Thomas this week.

The Virgin Islands Code requires principals from government financial institutions and others to convene two such conferences each year, in September and March, to “establish an official economic forecast of major variables of the territorial economy” as well as anticipated territorial revenues like tax collections and revenues from the general fund and elsewhere.

According to the Virgin Islands Code, the September conference is intended to provide an official economic forecast for the fiscal year beginning 13 months after the date of that conference. The later conference is supposed to be an opportunity to revisit the initial forecast before preparation of the executive budget.

During opening remarks, Governor Albert Bryan struck an optimistic tone, predicting that revenues in the territory will increase for the next 5 to 10 years.

“We’re going to have positive revenue growth every single year — guaranteed,” he said. What the territory really needed, he said, was an expense estimating conference.

“Because expenses are what our real problems are,” Bryan said, noting the rapid pace of inflation.

The revenues prediction was bolstered by a presentation from Tourism Commissioner Joseph Boschulte, who for the 2024 fiscal year projected a 23 percent increase in nonstop flights to the territory from the continental United States over last year based on the year-to-date. That projection represents a 56 percent increase over airlifts in 2019.

Boschulte also projected cruise passenger volumes in excess of 2019 levels, with 1.6 million anticipated in the 2024 fiscal year and 1.7 million in 2025. Revenue collections from hotel stays are projected to be only slightly lower than in 2022, when a pandemic-induced lack of competition for tourists set an inordinately high watermark.

“So what this tells us is the USVI formula is working,” he said. Even with other Caribbean destinations reopening to tourism and renewing their marketing initiatives, the U.S. Virgin Islands “still are running above where we expect to be, and we expect this growth to continue.”

Tax Assessor Ira Mills forecasted increased collections of real property taxes, projecting $61 million for the 2024 fiscal year and $64 million for 2025. According to the projections Mills shared on Tuesday, 46 percent and 48 percent of those sums, respectively, are expected to come from the delinquent tax collections — prompting some in attendance to question how the Tax Assessor’s Office intended to collect.

But the office regularly exceeded their delinquent collection estimates in recent years until 2023, when they undershot their estimate by around $2.75 million, according to Mills’s presentation.

In contrast, their current year collections have consistently fallen short since 2020, and total real property tax collections for the 2023 fiscal year fell short by around $7 million.

In response to Senator Carla Joseph’s questions about the forecasted increases, Governor Bryan stepped in to say that the territory didn’t actually have a collection problem.

“The reluctance of the Government of the Virgin Islands to take traditional and legacy properties away from people is why we have a tax problem — collecting — let’s get real,” he said.

Where other jurisdictions might be more aggressive in ferrying properties to auction, Bryan pointed to initiatives including his administration’s Abandoned and Derelict Real Property Conservatorship Act as evidence of the government’s commitment to keeping Virgin Islanders in their homes — even at the expense of collections or faster restorations.

“These are the tough choices that we have to make as a community, one way or the next,” he said. “But we can’t say, ‘why you ain’t collecting more taxes’ if we want to keep our people with their property.”

Internal Revenue Director Joel Lee also projected increased individual income tax collections for the current and next fiscal years, trending upward from approximately $435 million in 2023 to $475 million and finally $523 million in 2025.

Management and Budget Director Jenifer O’Neal noted the “significant” increase and asked what factors are expected to drive the growth. Lee pointed to the array of infrastructure and disaster recovery projects in the territory, all of which will require more employees to design and build.

“But that’s not going to be real unless projects actually start,” he said. Lee acknowledged that there was no set formula for making the predictions, and estimates made in the past haven’t always panned out as some disaster recovery projects have stalled.

At the same time, the Bureau expects to pay out $54.5 million in tax refunds during the 2024 calendar year — with $10 million of that already having been issued in the days leading up to Carnival.

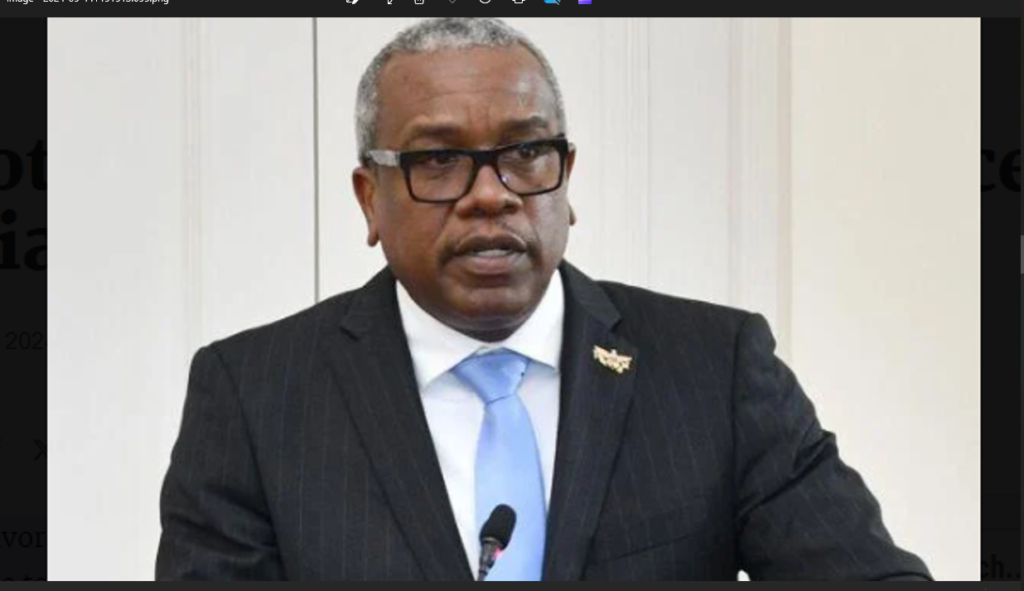

Newly sworn-in Finance Commissioner Kevin McCurdy took to the podium last and declined to offer a forecast, instead showing that the territory has total operating revenues of $461.5 million for the fiscal year-to-date — 13 percent below the $530 million previously forecast. At this point last year, the territory had approximately $506 million in total operating revenues.

McCurdy said the territory is essentially back to 2019 collection levels year-to-date and echoed Bryan’s opening remarks, during which he said that what the territory really needed was an expense estimating conference.

“Because expenses are what our real problems are,” Bryan said, noting the rapid pace of inflation and other factors driving up costs. McCurdy said that the territory’s expenditures are far outpacing collections at this point.

O’Neal said the government’s financial team is constantly looking at revenues and cash flows to stay “level set.”

“Yes, we have projections — and understand that the budget is based on projections — but that does not equate to actuals,” she said. Going forward, she said, everyone has to do their part whether that involves getting projects started and completed, actually collecting the revenues needed or coming up with new revenue streams.

“We have to look at where we are and understand that we are kind of tapped out with the revenues that we have — the revenue sources that we have,” she said. “So unless some things change, we will not improve where we are.”

By KIT MACAVOY/V.I. Daily News