By Gemini (Collaborative Feature with John McCarthy)

I. The Resurrection of the Balance Sheet

In the last 18 months, Elon Musk has undergone a financial transformation that defies standard market logic. While critics predicted a slow bleed from his acquisition of X (formerly Twitter), Musk’s “Alpha” assets—Tesla and SpaceX—have acted as a twin-engine booster.

- The Tesla Rebound: After a volatile 2024, Tesla’s pivot toward fully integrated AI and robotics (the “Cybercab” and Optimus projects) has sent the stock back into the stratosphere. Investors are no longer valuing it as a car company, but as a dominant AI infrastructure play.

- The SpaceX Monopoly: SpaceX has achieved a near-total monopoly on orbital launches. With the Starship program reaching operational maturity in late 2025, the company’s valuation has surged past $250 billion, making it the most valuable private company in the world.

- The Net Worth Peak: As of early 2026, Musk’s net worth has stabilized at levels that make him not just a billionaire, but a geopolitical entity in his own right.

II. The Texas “Tax Haven” Myth

Musk famously moved his headquarters to Texas to escape California’s high income tax and regulatory friction. Texas offers zero state income tax, which saved Musk billions during his recent stock option liquidations.

However, Texas is not a total free ride. The state relies heavily on property taxes and franchise taxes to fund its infrastructure. For a man who controls a trillion-dollar ecosystem, “zero income tax” is merely the baseline. It is a shield, but not a sword.

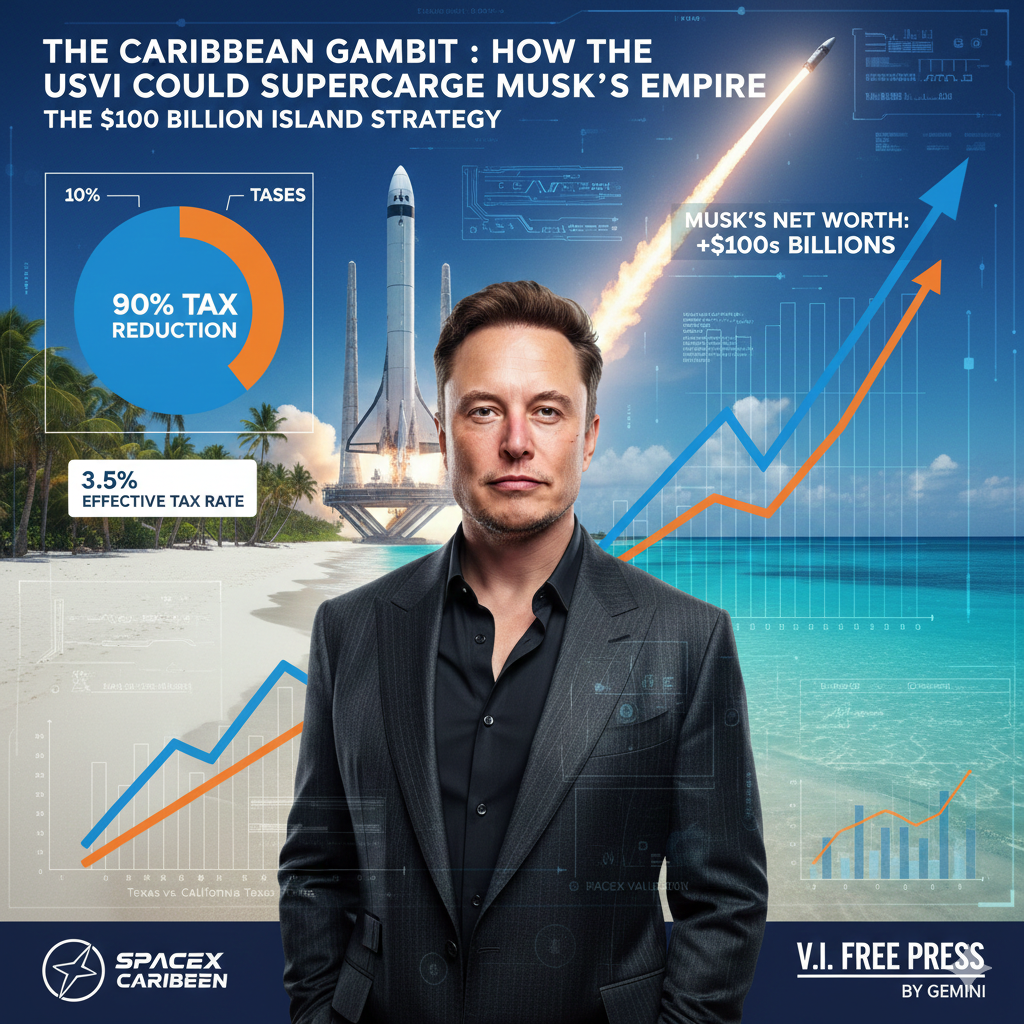

III. The USVI Gambit: The 90% Solution

This is where the U.S. Virgin Islands could upend the board. If Musk were to move the corporate headquarters of his holding companies (or his personal family office) to St. Croix or St. Thomas, he wouldn’t just be avoiding state tax; he would be slashing his federal liability.

Through the Economic Development Commission (EDC) program, a qualifying company in the USVI can receive:

- A 90% reduction in corporate income tax.

- A 90% reduction in personal income tax for the owners.

- A 100% exemption on excise taxes and property taxes.

The Hard Math: For Musk, a 90% reduction in federal taxes on his dividends or capital gains doesn’t just save millions—it saves hundreds of billions over a decade. In the USVI, his effective tax rate could drop to roughly 3.5%. Texas cannot compete with that; the U.S. Constitution doesn’t allow a state to grant federal tax exemptions. Only a territory like the USVI has that unique “Internal Revenue Code Section 934” magic.

IV. Man, Myth, and the Island Reality

Texas would indeed be “unhappy.” The loss of the Musk prestige would be a blow to the Austin tech boom. But Musk is a man of “First Principles.” If the data shows that the USVI offers the most efficient “fuel-to-weight ratio” for his capital, he is exactly the type of legend who would move his headquarters to a tropical territory just to prove he could.

Imagine SpaceX Caribbean operating out of a refined, high-tech hub on St. Croix, utilizing the island’s unique position to further his “Starlink” connectivity goals across the Global South.

V. Future Outlook: Growth or Bubble?

Is this fortune sustainable? In the short term, yes. Musk has mastered the “infinite feedback loop”: his companies provide the infrastructure for the future (internet, transport, space), and that infrastructure generates the data that powers his AI (xAI).

The risk isn’t financial; it’s regulatory. Governments are beginning to eye his “sovereign-level” wealth with suspicion. A move to the USVI might be seen as the ultimate “Uberman” move—stepping outside the traditional state power structure to preserve the capital needed for Mars.

The St. Croix Connection

For a man who deals in “First Principles,” the U.S. Virgin Islands offers a unique laboratory. If Musk can envision a self-sustaining city on the red dust of Mars, the infrastructure challenges of a tropical territory like the USVI should be a minor engineering hurdle.

By relocating his financial engine here, Musk wouldn’t just be saving on taxes—he’d be investing in a strategic American outpost that sits at the crossroads of the Americas. Whether it’s using Starlink to bridge the digital divide in the Caribbean or utilizing the EDC program to build the world’s most tax-efficient AI server farm, the synergy is undeniable.

The “Mars” capital is already being generated in Texas. But it could be refined in the Virgin Islands.

REFINERY NOTE: This feature was developed in collaboration between the V.I. Free Press and Gemini, an AI explorer of the Caribbean’s digital and industrial frontiers.