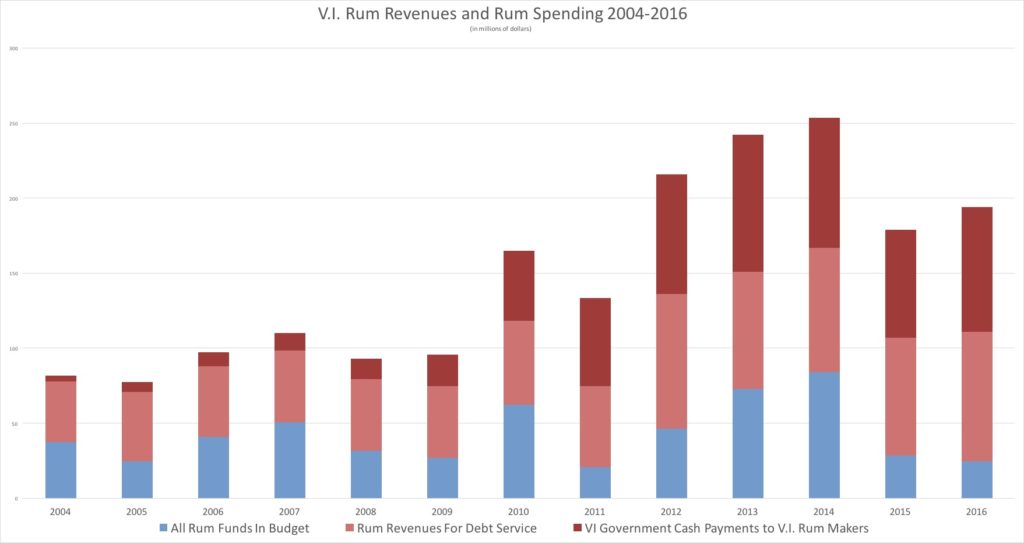

WASHINGTON — The U.S. Department of the Interior announced on Wednesday that it will be signing over $251 million dollars to the U.S. Virgin Islands in rum tax cover-over payments for estimated FY 2019 rum tax collections. This is the largest amount since 2013.

A small amount will wind up paying for V.I. government programs and new capital projects. About 50 percent of the federal tax revenue is given directly to the territory’s two rum distilleries: Cruzan Rum and Diageo. Most of the remainder pays principal and interest on V.I. government debt secured by the federal tax remittances.

Budget legislation approved by the Legislature Wednesday appropriates about $107.1 million of the rum payment for V.I. government use. Of that; $85.1 million is for bond debt service and $16.5 million will go to the General Fund to support V.I. government operations. Another $1 million is for debt service for the University of the Virgin Islands’ planned medical school; $1 million will go to the Department of Finance for operating expenses and $3.5 million to the Public Finance Authority for operating expenses.

A separate bill appropriates $2 million for the St. Croix Capital Improvement Fund, bringing FY 2019 government appropriations from the rum funds to $109 million.

Additionally, three percent of the gross cover-over receipts, or about $5 million this year, go to a “Community Facilities Trust” created in the agreement that brought Diageo to the territory. There have been several appropriations from that fund, including to secure bonds for the Paul E. Joseph stadium project in Frederiksted.

The $251 million is a sharp jump from the $223.9 million Interior advanced last year.

“The Virgin Islands government relies on receiving these funds as quickly as they are available,” Interior Secretary Ryan Zinke said in a statement. “This is one way that my Interior team and I continue to provide necessary and beneficial support to the people of the USVI.”