ROAD TOWN, Tortola – Britain agreed on Tuesday to order its overseas territories such as the British Virgin Islands and Cayman Islands to make secretive company ownership information public by the end of 2020 to try to tackle corruption and tax avoidance.

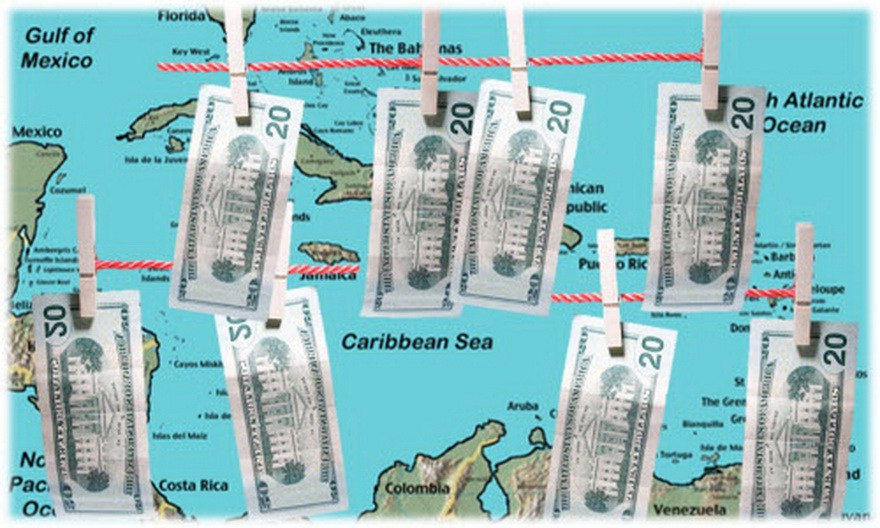

The move was hailed as a major victory by campaigners in the fight against tax avoidance and money laundering.

“This is the news we have been waiting for,” said Simon Kirkland, a campaigner at Christian Aid. “This is a major step forward in the fight against the tax avoidance, evasion and corruption that costs developing countries so dearly.”

Overseas territories and crown dependencies have come under increasing pressure to reveal who is behind anonymously owned companies, with campaign groups saying such secrecy aids money laundering, tax evasion and corrupt diversion of public funds from developing economies.

But Orlando Smith, premier of the British Virgin Islands, said he was “deeply disturbed” by developments in London, calling the new transparency policy “deeply flawed”.

“It is not only a breach of trust but calls into question our very relationship with the UK and the constitutional rights of the people of the BVI,” he said in a statement.

Several politicians in Britain’s ruling Conservative party teamed up with opposition Labor lawmakers to back the changes, which were first pushed by former Prime Minister David Cameron, but resisted by the overseas territories.

Many of these territories have large financial services sectors because they levy low taxes and ownership of businesses lacks transparency.

Despite repeated calls for more openness, British crown dependencies and overseas territories are only required to reveal information on the true owners of offshore companies to law enforcement bodies, and then only if asked.

Alan Duncan, a junior foreign office minister, told parliament the government would support an amendment brought by two members of parliament calling for a central register of company ownership in these territories as lawmakers debated an amendment on an anti-money laundering law.

Britain has been trying to clamp down on tax evasion and corrupt flows of money through its large financial services sector, but has faced resistance from some of its overseas territories because the secrecy and low taxes are what makes their finance sectors attractive.

RUSSIAN MONEY?

Margaret Hodge, the opposition Labor member of parliament who introduced the amendment, said it would help prevent tax evasion and disrupt the activities of criminals and militant groups.

“It will stop them exploiting our secret regime, hiding their toxic wealth and laundering money into the legitimate system, often for nefarious purposes,” she said.

“With open registers we will then know who owns what and where, and we will be able to see where the money flows, and then we will better equipped to root out dirty money and deal with the issues that arise from that.”

Naomi Hirst, a spokeswoman for the Global Witness anti-corruption group, said the move comes after four similar amendments submitted before parliament in the past failed.

She added the poisoning of a former Russian double agent in England in March had probably pressured the government to tackle the web of offshore shell companies used to invest in Britain.

Seven times the amount of money from Russia has flowed to British overseas territories rather than directly into Britain over the last decade, she said.

“This has really fired up imaginations and pointed out to even the most squeamish of politicians concerned about Russian’s role in the world that they need to look at this,” she said.

The amendment does not apply to the Isle of Man and the Channel Islands, because parliament does not have the right to impose its will on them.

(REUTERS)