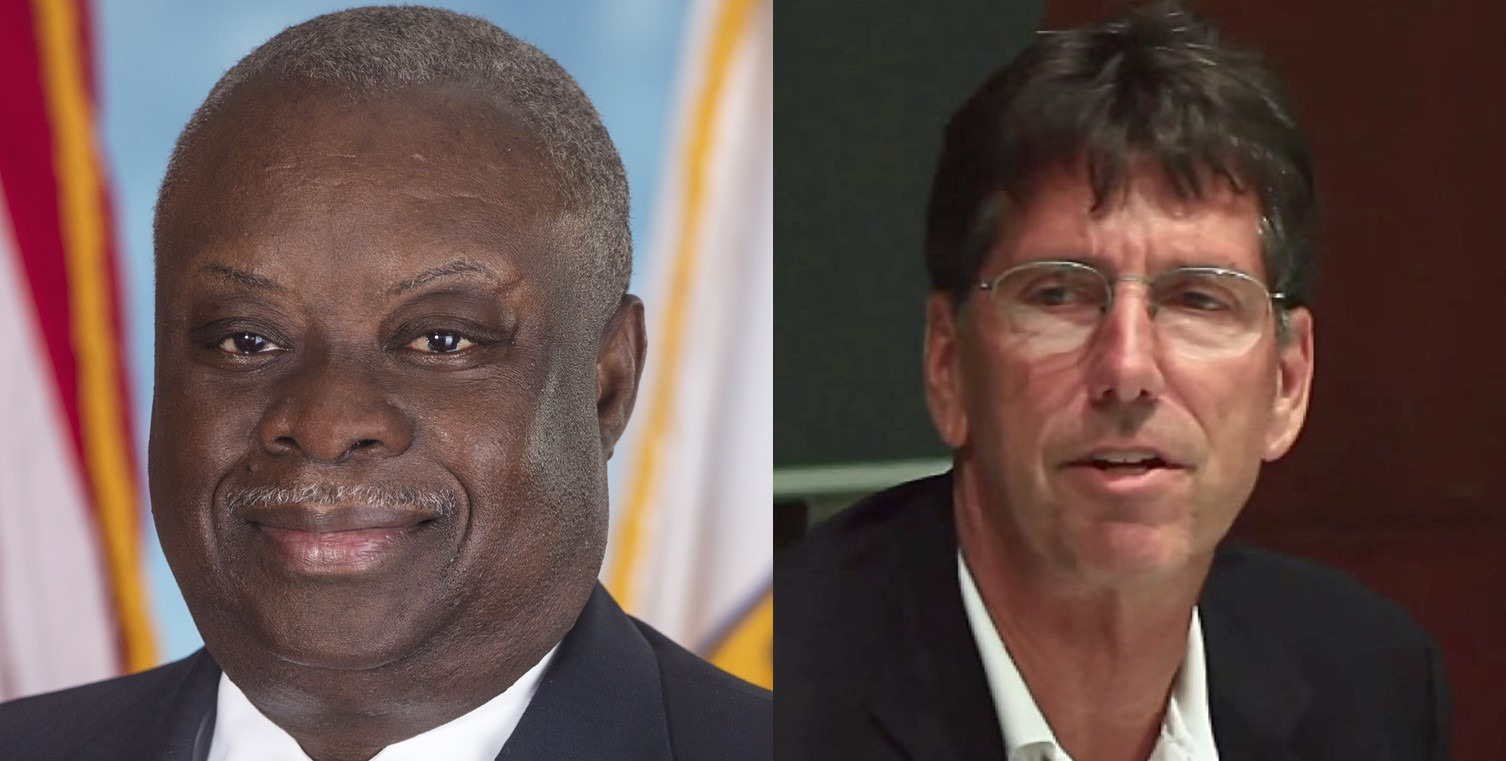

CHRISTIANSTED — At the time, Gov. Kenneth Mapp called it a “landmark” agreement.

What that means is that it can be “easily seen from a distance.” It doesn’t mean if it’s good or bad.

But that is the question. Whether Mapp negotiated a good deal for the territory with Limetree Bay Terminals in mid July.

Mapp said in a July 14 press conference that the deal he made with Limetree’s parent company ArcLight Capital Partners will bring the Virgin Islands $600 million over 10 years and at least 1,200 permanent jobs.

Independent candidate for governor Warren Mosler said it will pay us about $70 million up front, but will ultimately cost us at least $400 million — future government revenues given up for the payday loan we need now to make payroll.

“If the new contract brings in $600 million, it means we would have gotten about $1 billion under the 2015 contract,” Mosler told the Virgin Islands Free Press today.

Mosler believes Mapp tricked the 15 senators of the Legislature into thinking they were voting to re-start the St. Croix refinery — when permission to do so was already granted in the start-up agreement.

“Not one of our Senators realized Limetree was already restarting the refinery and paying the full taxes from the 2015 contract,” Mosler said. “Limetree already spent $44 million dollars going full speed ahead with hundreds of workers in modular housing — without this new contract.

What senators actually voted on was a measure that costs ArcLight Capital $70 million up front, but will grant them nearly half taxes going forward worth at least $400 million.

“So why the vote?” Mosler asked. “Our governor desperately needed fast cash before the election. So he got Limetree to pay $30 million dollars for land and houses — and $40 million in cash by pre-paying taxes. In return, we have to pay back the $40 million and cut their tax rates in half, costing us hundreds of millions of future tax revenue.”

The hedge fund mogul said that the Virgin Islands already had a “reasonable” contract in place from 2015 “and had we just left it in place Limetree would have continued the restart and paid us the higher tax rates, adding hundreds of millions of dollars to our general fund over the next several years and beyond.”

“We borrow $40 million and pay back hundreds of millions,” he said. “And that’s what the governor tricked the Senate into approving. Borrowing fast cash at loan shark rates — when they thought they were voting to refine oil.”

EDITOR’S NOTE: Warren Mosler is a world-renowned progressive economist and financial professional with nearly 50 years of global banking and securities experience.

https://drive.google.com/file/d/0B_uw3TKux24yZFBUZ0FiM0hFbEhHVVMza01jMzBmSThNbzc0/view

Can we vote for the most qualified candidate already?