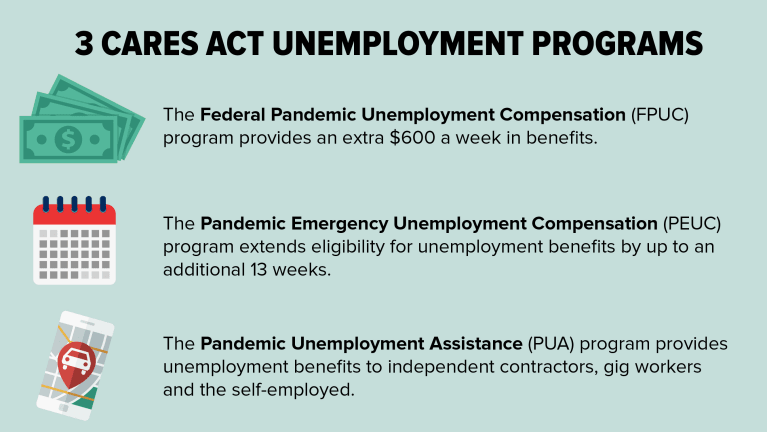

States are permitted to provide Pandemic Unemployment Assistance (PUA) to individuals who are self-employed, seeking part-time employment, or who otherwise would not qualify for regular unemployment compensation.

While UI and PUA both offer financial assistance to workers who are out of work or have less work, PUA has specific restrictions that may limit its benefits and coverage (for example, your unemployment must be a direct result of the COVID-19 pandemic). Also, the PUA program is time-limited to the end of the calendar year. Regular state UI doesn’t have these restrictions.

(“Self-Employed”) taxi drivers denial of PUA benefits, as is set forth in DOL April 13, 2021 mandatory work search form, conflicts with both federal and territorial law; the American Rescue Plan Act of 2021 and 24 V.I.C.§§ 302 and 304.

Taken in context, a “self employed” and an “insured-employee” are mutually exclusive terms; an individual cannot be “self employed” and an “insured-employee” at the same time when considered with all the factors that relate to PUA Payments under the American Rescue Plan Act of 2021 signed into law by President Biden.

Under the CARES Act, everyone receiving jobless benefits was entitled to a weekly supplement, which started at $600 per week and was later reduced to $300 per week.

Since the “Self-Employed” does not qualify to receive the benefits of VI government Unemployed insurance, why DOL is delaying paying taxi-drivers the weekly $300 from March 11, 2021 to September 6, 2021?

By KELVIN DENNIE/St. Croix Taxi Driver