NEW YORK — JPMorgan Chase in a court filing called the U.S. Virgin Islands “complicit in the crimes of Jeffrey Epstein,” saying the sex predator gave high-ranking officials there money, advice and favors in exchange for looking the other way when he trafficked young women to be abused on his island getaway.

“For two decades, and for long after JPMC exited Epstein as a client, the entity that most directly failed to protect public safety and most actively facilitated and benefited from Epstein’s continued criminal activity was the plaintiff in this case — the USVI government itself,” the bank said in the Manhattan federal court filing.

“Rather than stop him, they helped him,” JPMorgan said, citing millions of dollars in tax incentives and other benefits the territory gave Epstein.

That claim comes as JPMorgan defends itself against a civil lawsuit by the Virgin Islands, which alleges that the bank knowingly enabled Epstein’s sex trafficking and benefited from it when he was a customer from 1998 through 2013.

A spokesman for theVirgin Islands’ attorney general’s office told CNBC on Tuesday, “JPMorgan Chase facilitated Jeffrey Epstein’s abuse, and should be held accountable for violating the law.”

“This is an obvious attempt to shift blame away from JPMorgan Chase, which had a legal responsibility to report the evidence in its possession of Epstein’s human trafficking, and failed to do so,” the spokesman said.

The bank’s filing Tuesday asked Judge Jed Rakoff to deny a motion by the Virgin Islands that would preclude JPMorgan from raising certain so-called affirmative defenses to the lawsuit.

“USVI’s motion seeks to strike only those specific defenses that threaten to expose its relationship with Epstein,” the filing said.

In a footnote, the filing said the Virgin Islands had three governors over the past 16 years: John de Jongh, Kenneth Mapp and current governor Albert Bryan.

“As detailed herein, Epstein had close ties to each of them,” that footnote said.

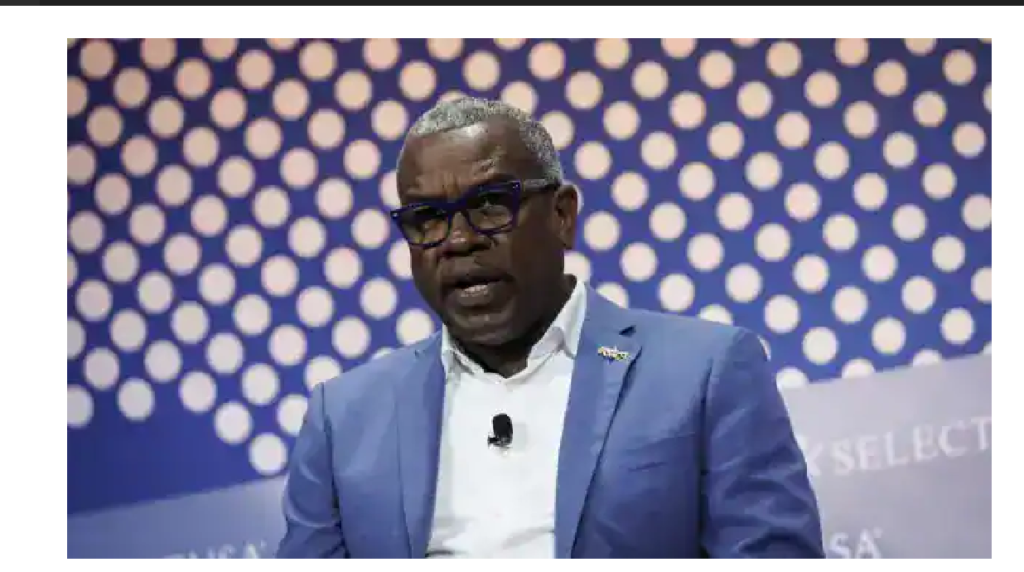

Earlier Tuesday, another court filing for the first time revealed that Bryan is scheduled to be deposed June 6 for the lawsuit. A source familiar with the situation told CNBC that JPMorgan requested the deposition of Bryan, who has been governor since 2019.

JPMorgan CEO Jamie Dimon is scheduled to be deposed in the suit Friday in New York.

Rakoff last week authorized the Virgin Islands to serve a subpoena for Tesla CEO Elon Musk on his electric car company, seeking documents that Musk may have showing any communications involving him, Epstein and JPMorgan.

That subpoena is based on suspicion by the territory that Epstein may have referred Musk or tried to refer him to the bank as a client.

Epstein, a former friend of Donald Trump and Bill Clinton, maintained a home on a private island in the territory where he sexually abused many young women over the years. He used money from his JPMorgan accounts to pay women and fly them there.

In its filing Tuesday, JPMorgan noted that when Epstein was released from a Florida jail after pleading guilty to procuring a minor for sex, he tried to arrange for his parole to be transferred from that state to the Virgin Islands, where he registered as a sex offender. He also maintained his primary residence in the territory, which “put him under USVI law enforcement’s direct jurisdiction and supervision,” the filing said.

The bank alleges there was a “decades-long quid pro quo between Epstein and the USVI government” that took three forms.

“First, high-ranking USVI officials spent years courting and gladly accepting Epstein’s influence in the form of gifts, favors, and political donations,” the filing said.

“Second, in exchange, USVI granted Epstein preferential treatment in the form of more than $ [amount redacted] million in tax incentives, among other benefits. Third, and most troublingly, USVI protected Epstein, fostering the perfect conditions for Epstein’s criminal conduct to continue undetected.”

Specifically, the filing says Epstein supported the candidacy of Stacey Plaskett, the Virgin Islands delegate to the U.S. House of Representatives, after she worked for the USVI Economic Development Authority, which awarded Epstein “massive tax benefits.” Plaskett had also worked at a law firm that represented him in business affairs, the filing says.

Epstein and his employees donated more than $30,000 to Plaskett’s congressional races, according to the bank.

The filing said that Epstein’s “primary conduit for spreading money and influence through” Virgin Islands government was then-first lady Cecile de Jongh, the wife of former Gov. de Jongh, who served from 2007 through 2015.

And “despite her public role and official duties, First Lady de Jongh managed Epstein’s USVI-based companies … receiving from Epstein a salary, bonuses and other benefits,” the filing said.

Much of the details of the claims related to Cecile de Jongh are redacted in the filing, but in one section the bank says that in addition to working for his companies she “extensively lobbied on his behalf with government officials, including the governor.”

In another heavily redacted section, the filing says the Virgin Islands “aided Epstein’s criminal activity.” The specific allegations as to how the government did that is blacked out.

Almost completely redacted is a section of the filing entitled, “Epstein exerted influence over USVI sex offender legislation and received lax monitoring.” In one unredacted section, the bank’s lawyers wrote, “While the USVI did conduct site visits of Epstein’s residences, those inspections were cursory at best.”

“Despite the direct infusions of lucrative tax incentives, [redacted] and lax enforcement, Epstein still could not freely transport and exploit young women without assistance from USVI government officials,” the filing said.

“In exchange for Epstein’s cash and gifts, USVI made life easy for him,” the filing said. “The government mitigated any burdens from his sex offender status. And it made sure that no one asked too many questions about his transport and keeping of young girls on his island.”

The lawsuit against JPMorgan was filed in late December by then-Virgin Islands Attorney General Denise George, who a month earlier had obtained a $105 million settlement from Epstein’s estate. Days after she filed that suit, Bryan fired George, who had been attorney general for four years.

The governor fired George reportedly because she failed to alert him that she planned to sue JPMorgan, which is the largest bank in the United States.

Despite George’s firing, the Virgin Islands has continued to aggressively pursue its litigation against the bank.

On Tuesday, there was another in a series of private telephone conferences with Rakoff over the case.

A public docket entry summarized the outcome of that conference, which included lawyers for the Virgin Islands, JPMorgan, former JPMorgan executive Jes Staley and an Epstein accuser who has a separate, similar lawsuit pending against the bank. JPMorgan is trying to shift any legal liability it may have in the suit to Staley, who was a point of contact for Epstein at the bank.

“The deposition of Albert Bryan, Jr. is ordered to proceed on June 6,” that docket entry says.

The entry also says that “all parties other than JP Morgan are ordered to contact former officers and directors of JP Morgan only through counsel.”

CNBC requested comment from lawyers for the Virgin Islands and from JPMorgan about the conference Tuesday.

Epstein, 66, died by suicide in a Manhattan jail in August 2019, a month after he was arrested and charged in Manhattan federal court with child sex trafficking.

Epstein pleaded guilty in 2008 to a Florida state charge of soliciting sex from an underage girl and was sentenced to 13 months in jail.

His prior criminal case and stint in jail, which were known to JPMorgan at the time, came in the middle of his tenure as a customer of the bank, where he maintained accounts from 1998 until the bank severed its relationship with him in 2013.

Epstein became a customer of Deutsche Bank after that.

Deutsche Bank last week agreed to settle a Manhattan federal court lawsuit filed by another Epstein accuser who alleged that bank enabled and benefited from his sex trafficking. Deutsche Bank will pay Epstein victims $75 million in that deal.

Deutsche Bank in 2020 agreed to pay a $150 million fine to New York’s financial regulator for its dealings with Epstein and other issues.

“We acknowledge our error onboarding Epstein in 2013, and the weaknesses in our processes, and have learnt from our mistakes and our shortcomings,” bank spokesman Dylan Riddle said last week.

By DAN MANGAN/CNBC

Pingback: JPMorgan Chase Says USVI Government Enabled Jeffrey Epstein Sex Trafficking – Virgin Islands Free Press - CaribbeanNewsRoundup.com