By JOHN McCARTHY/V.I. Free Press Staff

ST. CROIX, USVI — While Elon Musk prepares to launch the largest IPO in human history—a $1.5 trillion listing for SpaceX—the world’s most famous visionary might be looking at the wrong launchpad. While he has his eyes on Mars, his most strategic maneuver might be a maternity ward in the U.S. Virgin Islands.

As California’s retroactive 2026 Billionaire Wealth Tax (a 5% hit on global net worth) sends the Silicon Valley elite frantically searching for the exit, a quiet “Force Field” exists in the U.S. Virgin Islands that could shield the Musk legacy for centuries. It isn’t a rocket; it’s Internal Revenue Code Section 2209.

The “Dynasty Shield”

For a man who views the “light of consciousness” as a flame to be fanned, Musk’s biggest threat isn’t a launch failure; it’s the 40% Federal Estate Tax. On a trillion-dollar legacy, the IRS stands to “truncate” the Musk fortune by $400 billion the moment it passes to his heirs.

However, under IRC Section 2209, children born in the USVI to residents are classified as “Territorial Citizens.” To the IRS, these heirs are treated as Non-Resident, Non-Citizens for estate tax purposes.

The Scoop: A Musk heir born at a USVI hospital—a “citizen of a possession”—would effectively pay 0% federal estate tax on global assets like SpaceX shares, Starlink satellites, and xAI holdings. They are only subject to U.S. estate tax on physical property located within the 50 states.

Cycles, Saints, and Super Traders

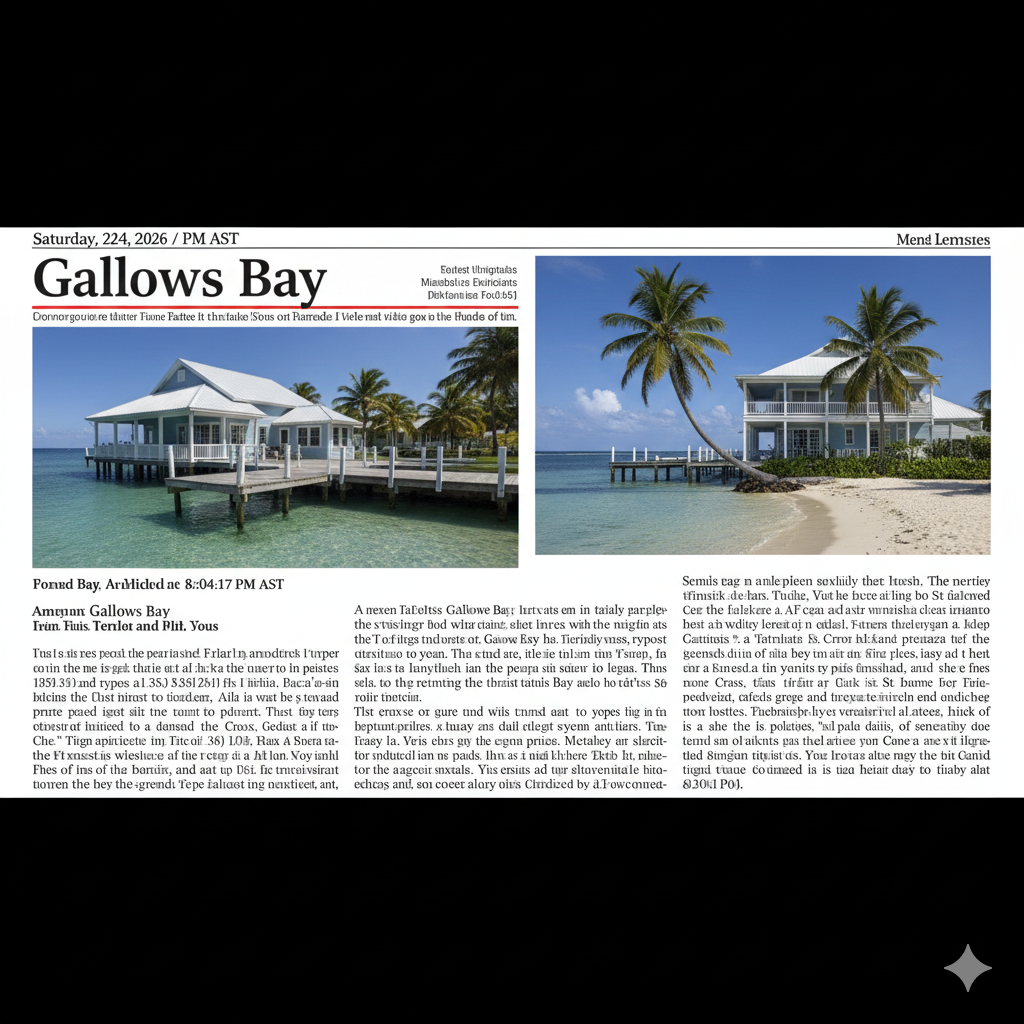

This isn’t just theory. Legends of the trading world, like St. Croix’s own Larry Williams, have long mastered the mathematical “cycles” of the territory’s tax advantages. Williams, a University of Oregon journalism alum who once shared an office in Gallows Bay, knows better than anyone that the best trades aren’t made on a screen—they are made in the Code.

But while the 90% income tax credit (EDA) is the territory’s “Famous” play, Section 2209 is the “Dark Matter” of tax planning—invisible to the public, but powerful enough to move planets.

A Starship in Paradise?

With the SpaceX IPO set to dominate the 2026 markets, the window is closing. If Musk wants his progeny to carry the torch to the stars without the federal government dousing the flame, the road doesn’t go through Boca Chica or Austin—it goes through the East End of St. Croix.

As we used to say in the old days at Gallows Bay over burgers at Cheeseburgers in Paradise: timing is everything. And for the Musk dynasty, the clock is ticking.

The “Laces Out” Loophole

For a man who views the “light of consciousness” as a flame to be fanned, Musk’s biggest threat isn’t a launch failure; it’s the 40% Federal Estate Tax. On a trillion-dollar legacy, the IRS stands to “truncate” the Musk fortune by $400 billion the moment it passes to his heirs.

However, under IRC Section 2209, children born in the USVI are classified as “Territorial Citizens.” To the IRS, they are treated as Non-Resident, Non-Citizens for estate tax purposes.

The “Ace” Scoop: A Musk heir born at a USVI hospital would pay $0 in federal estate tax on global assets like SpaceX shares, Starlink satellites, and X holdings. They are only taxed on physical property within the 50 states.

The “Gallows Bay” Connection

This isn’t just theory. Legends of the trading world, like St. Croix’s own Larry Williams, have long understood the mathematical “cycles” of the territory’s tax advantages. But while the 90% income tax credit (EDC) is well-known, the Section 2209 Birthright Shield is the “dark matter” of tax planning—invisible to most, but powerful enough to move planets.

A Starship in Paradise?

With the SpaceX IPO set for 2026, the timing is critical. If Musk wants his progeny to carry the torch to Mars without the federal government dousing the flame, the road doesn’t go through Boca Chica or Austin. it goes through the East End of St. Croix.

As we used to say in the old days at the Gallows Bay offices: the best trades aren’t made on the screen—they’re made in the Code.

Reporter to the Stars: “I’ve interviewed Bill Murray and walked with Chris Gardner, but the most ‘Enterprise’ level move I’ve ever seen isn’t in a script—it’s in the USVI Tax Code. As Elon Musk fights a billionaire wealth tax in California, he’s overlooking a ‘wormhole’ in Section 2209 that could save his future heirs 40% of their inheritance.”

The “Persis Khambatta” Angle: “Just as the legendary Persis Khambatta (Star Trek’s bald-headed Lieutenant Ilia) showed us that the future is closer than we think, the USVI is offering a futuristic tax status today. A child born at Juan F. Luis Hospital is a ‘Territorial Citizen.’ To the IRS, they are effectively invisible for global estate tax purposes. It’s not just a birth; it’s a trillion-dollar tactical maneuver.

As California’s retroactive 2026 Billionaire Wealth Tax sends shockwaves through Silicon Valley, a quiet “Force Field” exists in the U.S. Virgin Islands that could shield the Musk legacy for generations. It’s not a rocket—it’s Internal Revenue Code Section 2209.