BRIDGETOWN — The Caribbean is vital to the strategic interests of the United States. It is the U.S. “front door” for maritime logistics, finance and tourism and generations of immigrants from the Caribbean that have helped shape U.S. society and culture

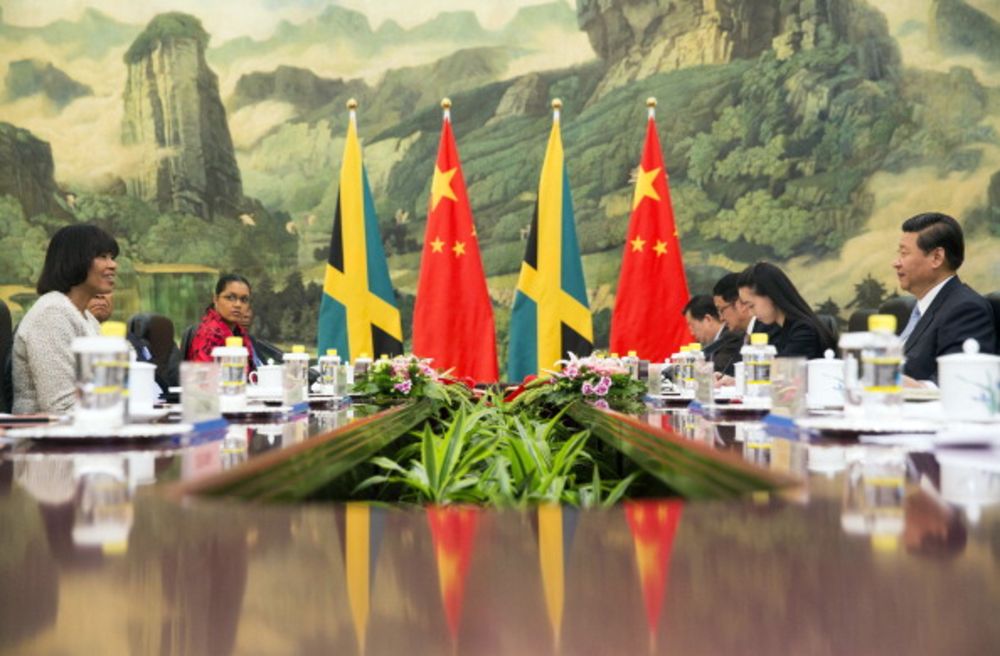

Given the strategic position of the Caribbean it is not surprising that China is also working to build its presence there, or that, with a relative dearth of U.S. resources, the region has been receptive.

China has thus far refrained from building expensive bases or engaging in provocative military alliances, yet it has built a no less significant web of influence through gifts, political courtship, loan-backed infrastructure projects, including strategically located ports, tourism and logistics-sector investments, as well as participation in the region’s bauxite, gold, timber and petroleum sectors.

An important part of that diversity is the region’s economic base. While tourism has played an important role in the livelihood of many Caribbean nations, in Guyana and Suriname, as in Trinidad and Tobago, the development of the nation’s oil wealth is key to the national economy and plans for development.

In Guyana, the discovery of at least 8 billion barrels of recoverable oil, whose commercial production came on-line in 2020, has begun to transform what was once one of the Caribbean basin’s poorest countries into what is expected to be one of its wealthiest. By 2025, according to the IMF, Guyana’s per capita GDP is set to pass $15,000, a four-fold jump in just a decade.

Guyana is also an important success story for the United States. During 2018-2019, as political actors within the country positioned themselves to control the nation’s expected oil bonanza, the U.S. gained an important, if unexpected friend. Standing for principle, it pressured the Partnership for National Unity (APNU) government of David Granger, with which it had had positive relations, to respect elections called for under the Guyanese constitution, and to honor their results, although the ultimate result was APNU’s defeat by the People’s Progressive Party (PPP), with whom U.S. relations had previously been difficult.

The principled U.S. posture opened a door for the PPP to overcome mistrust of the U.S. rooted in a perceived U.S. historic role in the exclusion of PPP founding father Cheddi Jagan from power. In the process, the U.S. gained an important partner in the new PPP government of Irfaan Ali, which has supported Washington in the region on issues from Venezuela and Cuba to restraint in its dealings with the PRC, even as oil wealth began to transform the country.

The strategic importance of Guyana and its friendship with the United States is magnified by the advance of China in the Caribbean. China National Corporation for Exploration and Development of Oil and Gas (CNODC) has a 30 percent stake in the consortium developing the Stabroek Block. China-based companies such as Huawei and China Harbour are well established in the country, with longstanding relationships with the current government. As in other parts of the Caribbean, China has long donated needed equipment to the Guyana Defense Force and police, bringing their senior leaders to China for training and goodwill-building institutional visits.

It is thus remarkable that there has been no serious progress on projects in Guyana by the Development Finance Corporation, designed largely to provide vulnerable countries an alternative to predatory Chinese economic projects. One likely reason is that Guyana’s oil-driven miracle is inconveniently out of step with the “all green energy” framework driving concepts within the left in both the Biden administration and Capitol Hill.

While the image of gentle sea breezes and sun-drenched Caribbean islands makes wind and solar power seem a reasonable solution for Caribbean development, Guyana’s example highlights how overzealous application of environmental piety as a policy filter disrespects Caribbean diversity, with respect to the composition of its economies, the needs of its peoples and the strategic imperatives of China’s advance. The United States can and should pursue endeavors that support environmentally friendly energy in the countries and situations where they make sense, but not by expecting our partners to set aside their best short-term hope for economic development because it does not align with Washington’s current environmental piety.

However much the Ali government has sought, in good faith, to accommodate the U.S., It is unrealistic and arrogant to presume that Guyana would halt its dramatic and long-anticipated economic transformation mid-course, relegating itself to marginally productive sugar and rice farming while awaiting vague promises of alternative future “green development” options on the scale of its oil. The rapid rise in expected GDP per capita after decades of grinding poverty means Guyana is ready to seize the moment. For Guyana, the hypocrisy is deepened because the alternatives for a Guyana condemned to near-term poverty, including bauxite, gold mining and the timber industry, are even more damaging for the environment.

Despite the present government’s goodwill toward the U.S., if Washington refuses to work with Guyana because its economic miracle is based on oil, the most likely reaction of its leadership will be to shrug and work with the Chinese, unnecessarily deepening the influence of China in the country and the Caribbean and increasing potential governance problems. The U.S. has only to look to Guyana’s neighbor Venezuela, where “state-owned” PDVSA has China as its most important creditor.

Evan Ellis is Latin America studies professor with the U.S. Army War College Strategic Studies Institute.

Ryan C. Berg is senior fellow in the Americas Program at the Center for Strategic and International Studies.

Kristie Pellecchia is principal of Pellecchia International, an advisory firm focused on capital markets, policy and partnerships.

SOURCE: MSN News