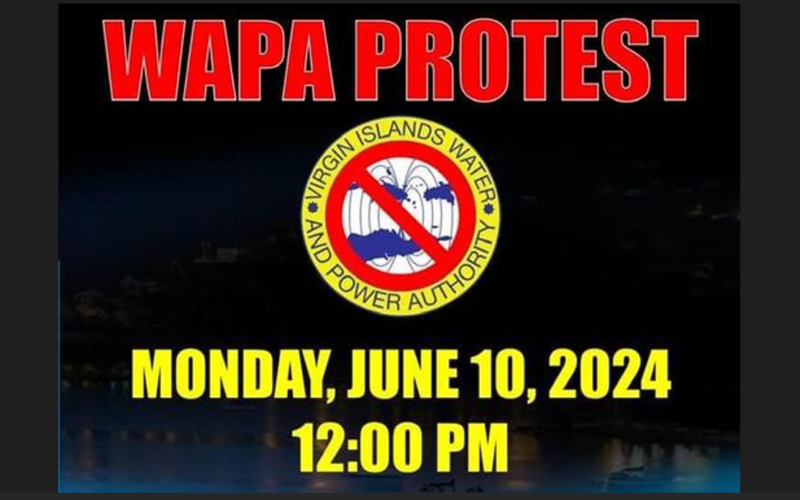

CHRISTIANSTED — Hundreds of households and thousands of people on St. Croix lost electricity for hours after a generator shut down early this afternoon, the

Read more

CHRISTIANSTED — Hundreds of households and thousands of people on St. Croix lost electricity for hours after a generator shut down early this afternoon, the

Read more

BMW is recalling more than 291,000 SUVs in the U.S. because the interior cargo rails can detach in a crash, increasing the risk of injury

Read more

CHARLOTTE AMALIE — Power failures continued this week in the St. Thomas-St. John district for a third day in a row Thursday, as the Virgin

Read more

CHARLOTTE AMALIE — FirstBank Virgin Islands is being sued by a Paradise Point tram operator who claims the bank deducted excessive credit card fees from

Read more

TOKYO — Nissan issued a “Do Not Drive” warning for more than 83,000 vehicles with the model year 2002-2006 equipped with recalled Takata air bags.

Read more

MANILA — Multiple ready-to-eat meat products were illegally imported from the Philippines, prompting the U.S. Department of Agriculture to issue a public health alert. The department’s Food

Read more

CHRISTIANSTED — The US Virgin Islands’ Consumer Price Index (CPI), which measures a basket of goods and services, rose 9.8 percent annually in 2022, compared to

Read more

A Delta flight from Detroit to Amsterdam was diverted to New York’s Kennedy Airport after passengers were served spoiled food NEW YORK — A Delta flight

Read more

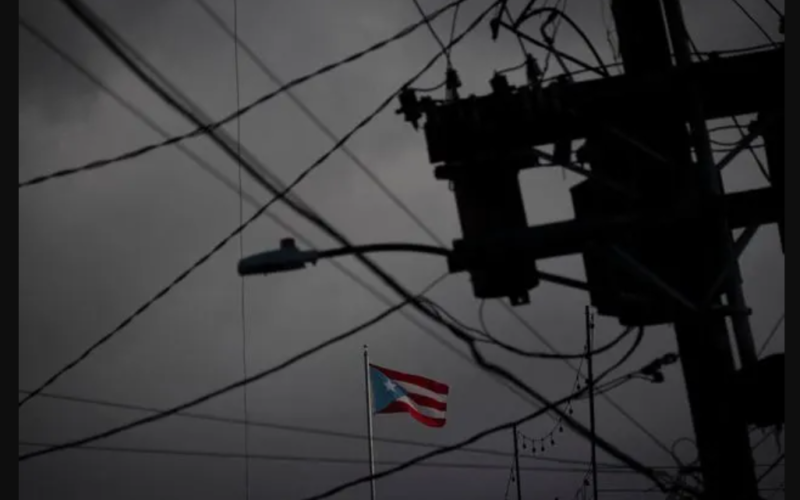

SAN JUAN — A widespread power outage hit Puerto Rico Wednesday night, leaving more than 350,000 customers without electricity after two of the U.S. territory’s

Read more

CHARLOTTE AMALIE — Virgin Islands Water and Power Authority crews repaired a major transmission line in the St. Thomas-St. John District on Saturday. But rolling

Read more